Russian composite reinforcement market. What next?

Russian composite reinforcement market.

What next?

The expiring 2014 was anything but simple for the Russian economy; a modest ascend in many segments, including the construction branch, yielded to recession. The reasons are well-known – the Ukrainian crisis, the oil becoming cheaper and cheaper, and the western sanctions. Let’s clear up the composite reinforcement market behavior in such unfavorable conditions and what to wait for in 2015.

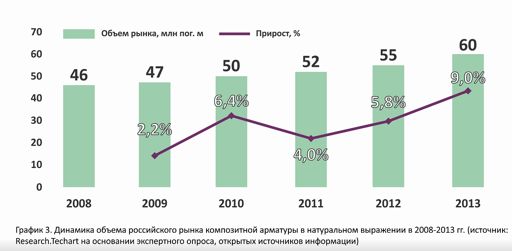

For a start, let’s have a look at the following diagram:

Diagram 3. Russian composite reinforcement market behavior in volume terms in 2008-2013 (source: Research.Techart on the basis of expert survey and open information sources)

For the last 5 years we have observed a sustainable growth of the composite reinforcement market. It is primarily connected with material properties – it’s cheaper than metal by 30% at the average and 9 times lighter, therefore, mounting and logistics costыare also reduced. The Russian construction industry can be hardly called advanced; the Russian construction companies’ conservatism restrains introduction of new materials greatly, but composite advantages overbalance and they are slowly but surely seizing the reinforcement market. This was the situation before 2014.

In January of 2014 a momentous event for all reinforcement manufacturers took place. A state standard for composite reinforcement production was issued. GOST-31938-2012 had been long expected, lively discussed and appeared to be a good argument in favor of composites. That is not to say that construction companies rushed to buy fiberglass, but many major suspended projects supported the use of composites, and surely designers started feeling much more free with the material. There have been no production volume data as of 2014 so far, it won’t appear till March of 2015, but it is safe to say that during the year a good increase was observed, including supplies of raw materials for composite reinforcement production. The Russian manufacturers – Alabuga and Gus Khrustalny, as well as Jushi Chinese roving suppliers note the growth in the volume of supplies to reinforcement manufacturers by 10-12% in the aggregate. The above diagram shows that the market growth is only gaining momentum, with the assumption that the recession is gaining momentum too. It seems absurd, but still…

What does the recession mean for a construction company? Firstly, it’s a tougher fight for construction projects: those who managed to get a job will survive, those who failed – well, sorry, this is market economy. Secondly, saving, saving and saving! Moreover, the customer has to save too. And how to save efficiently? The answer is simple – upgrade and new, cheaper materials and technologies. Surely, these, arguments don’t work everywhere, the quality of Russian construction company management is far from ideal, and many companies fulfil state orders, when no one cares about the saving. But each recession brings up the problem of “to be or not to be” again and again, and as you know, “for every question there is an answer”. It means that greater and greater number of companies will carry out optimization, and search for better materials and technologies. And due to this the composite branch in Russia will survive and prosper in many aspects thanks to the recession. It’s difficult to speak about the figures in advance, but there is another factor to appear in 2015 – the issue of a set of rules for design, construction and testing of composite-reinforced concrete structures. SP 63.13330.2012 has been developed since 2012, by now the second edition has been issued, and it will be approved in Q3-4 of 2015. One needn’t be an expert to access the market response. Today even if the customer wants, the builder can, but the designer says it’s dangerous, no one will risk it. When there will be a set of rules, the designer will be secured, and will even propose the cheaper and more efficient solution with composites. All things considered, I guess that the growth of composite market in Russia will amount in 2015 to 10-12%, and to 15% in 2016.

The Russian composite market is young and rapidly growing, but as you know, every product has its “saturation point”. Read in the next articles in December of the current year about when Russian composite reinforcement manufacturers will reach saturation point, why there are so much low-quality reinforcements at the Russian market and where they come from.

Best regards, Malashkin Alexey, 8(909)328-80-97

en.ruarmatura.ru